September, 2015

Football fans always get excited about offensive prowess, but they also know that when it counts, it is the defense that wins games. After a seven-year run in theU.S. stock markets leading to near-record valuations, veteran players know it is time for some solid defense by reducing risk in equity portfolios. The question for investors is: how to play defense in this increasingly uncertain world?

There are three primary ways to reduce equity risk. First, by significantly reducing equity exposure or exiting the equity markets completely. Traditionally, proceeds from equity sales are reinvested in bonds to await cheaper equity prices. This strategy has often worked in prior market downturns – and it may initially work with the next one – but we foresee a day when bonds sell off along with the stock market. It also requires some market-timing expertise.

The second strategy is the traditional diversification model touted by mainstream financial advisers. This model includes a broad mix of higher risk-assets in order to reduce overall portfolio risk. The theory states that, by mixing U.S., international, small and large-capitalization stocks, overall risk is reduced since these stock categories typically do not move in lockstep. This theory has led many investors to actually increase their overall equity portfolio risk (as we have recently experienced) since equities in different corners of the globe can all quickly tumble together during a contagion. So although traditional diversification may prove beneficial during normal times, it fails miserably during periods of systemic crises such as 2008. In our view, record debt levels throughout the world, combined with unprecedented monetary expansion, increase the likelihood of systemic risk.

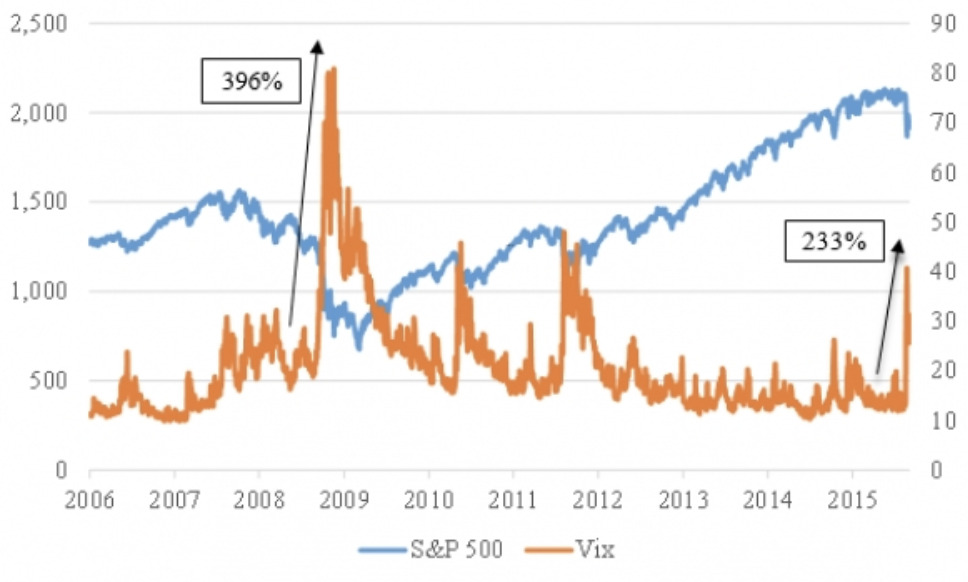

Hedging, the third and most compelling method to reduce equity risk, uses assets which should increase in value as stock markets decline. Traditionally bonds have performed this task, but as discussed above, those days may be ending. An asset which may now fulfill that role is volatility itself. Today, volatility is a tradable investment vehicle. Commonly referred to as the “VIX”, volatility reflects levels of risk in the stock market and rises as investors become more fearful. In two consecutive trading days in late August (2015), volatility rose by over 45% each day. The increase in volatility from the August low-to-high was over 230%!

However, other than periods of turmoil, the VIX is often flat or slowly declining. Therefore, an active-management approach is essential.

There are several investment funds which employ strategies that allow participation in rising equity markets, yet utilize volatility to eliminate or at least mitigate the risk of bear markets. Some volatility investment vehicles can even have exceptional returns during deep equity drawdowns. Even small positions in volatility can provide substantial benefits during market downturns. Today, volatility should be considered a key asset class and legitimate strategy for playing defense against the risk of a systemic crisis.