March, 2017

complacency (noun): a feeling of quiet pleasure or security, often while unaware of some potential danger, defect, or the like.

The financial markets feel complacent. Time and time again, stock market investors merely shrug at adverse financial, economic, and political news. Even the Federal Reserve’s rate hike on March 15th failed to elicit a negative reaction. And the statistics support the anecdotes.

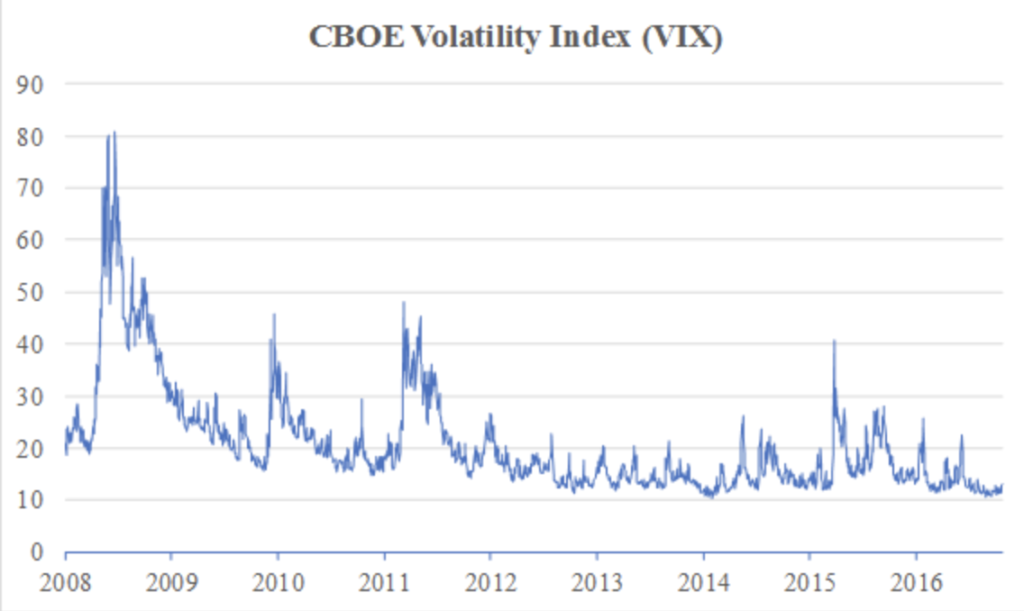

Financial markets typically equate risk with volatility. The greater the volatility generated by stock prices, the greater the risk of the stock market. The most common measure of risk is the Chicago Board Options Exchange (CBOE) Volatility Index, also known as the VIX. Constructed from the implied volatilities of a wide range of S&P 500 index options, it purports to measure expectations about near-term (30-day) volatility.

If high VIX levels indicate fear within the stock market, low levels surely suggest complacency. It is not unexpected, as long bull markets often breed complacency. But the level of worry and fear of a stock market decline has dropped to unusually low levels.

For much of March (through the 24th), the VIX ranged between 11.0 and 13.1, far lower than its median (17.5) or average (20.7) since the summer of 2008. And far, far below highs observed as recently as 2015.1

Even the Federal Reserve appears worried. In its January 31st to February 1st Federal Open Market Committee meeting minutes, the central bank “expressed concern that the low level of implied volatility in equity markets appeared inconsistent with the considerable uncertainty attending the outlook.”2

What are these uncertainties? To name but a few in the near term:

Potential additional rate hikes by the Federal Reserve;

Likelihood of a European banking crisis with a probable summertime Greek default; Monetary instability if the European election cycle disrupts the future of the eurozone;

- Potential trade war with China; and

U.S. fiscal issues and legislative stalemates delaying or obstructing tax reform.

In December 1996, then Federal Reserve Chairman Greenspan famously implied stock market levels at the time reflected “irrational exuberance.”3 He was early, but he was right (and, quite frankly, he should have been right as he was almost singularly responsible for the dot.com bubble).

If the 1996 stock market reflected irrational exuberance, today’s stock market reflects irrational complacency. Combined with extreme market valuations, investors should be wary, for while sentiment may move markets, eventually reality moves sentiment.

Endnotes:

- Federal Reserve Bank of St. Louis. https://www.stlouisfed.org/

- Minutes of the Federal Open Market Committee, January 31-February 1. https://www.federalreserve.gov/monetarypolicy/fomcminutes20170201.htm

- “The Challenge of Central Banking in a Democratic Society.” Remarks by Chairman Alan Greenspan at The American Enterprise Institute for Public Policy Research, (Washington, DC) 5 December 1996. https://www.federalreserve.gov/BOARDDOCS/SPEECHES/19961205.htm