“Unfiltered Tobacco”

The U.S. stock markets are precariously at or near record valuation levels. As of this writing, the Shiller Price-to-Earnings ratio (a.k.a. Cyclically Adjusted PE Ratio, or CAPE ratio) for the S&P500 stood well north of 30 and was historically surpassed solely by the technology bubble of the late 1990s.1 Combined with an extremely uncertain and potentially deteriorating economic situation, current equity valuations suggest this stock market is one of the most overvalued – and therefore potentially dangerous – in history.

While many techniques can decrease the risk for an investor’s equity position, perhaps one of the simplest and effective consists of overweighting sustainable, high-divided yielding stocks. In a bear market, such stocks should theoretically decrease less than the market overall since any fall in prices would increase dividend yields which would attract attention, generate investor demand, and increase the stock price.

Surprisingly, despite the U.S. stock market’s current valuation levels, several industries appear to offer sustainable, high-dividend-yielding stocks. Perhaps the most compelling of these are tobacco stocks.

Why Tobacco Stocks Exhibit High-Dividend Yields

While tobacco stocks have long been shunned by many retail investors due to social distaste and opprobrium, their neglect by institutional investors has been bolstered by the incredible acceptance and growth of the ESG (“environmental, social, and governance”) movement.

The term itself was only coined in a 2005 landmark study entitled “Who Cares Wins”.2 Current estimates anticipate continued exponential growth in ESG-mandated assets. In the United States, it is expected that half of all professionally managed investing will be ESG-mandated by 2025.3

One could argue tobacco stocks do not conflict with ESG investing per se, but many consider them to violate the “social” requirement. In support, ESG advocates cite the third item on the United Nation’s Sustainable Development Goals which promotes universal “good health and well-being” in addition to other ethical and moral criteria.4 As such, ESG investing typically eschews tobacco stocks.

Many also avoid tobacco stocks due to their “low growth” revenue prospects. This bias has been heightened in recent years by investors’ strong demand for “growth” over “value” stocks.

In developed countries, smoking is certainly a low-growth business. According to a weekly Gallup poll, the percentage of those having smoked a cigarette within the last week dropped from almost half of Americans in the 1950s to just 15% today.5 Many other developed countries exhibit similarly significant trends.

In general, the investment world either ignores tobacco or views it as a dying industry. This creates an opportunity –

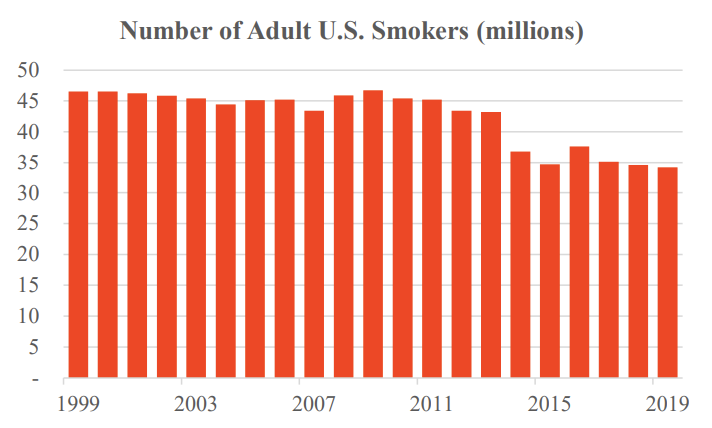

Smoking may kill, but it is not dying. At least not as quickly as the annual Gallup poll suggests. First, while the percentage of the smoking population in the U.S. has certainly decreased, in absolute numbers, the decline is far less dramatic:6

Second, while smoking in the developed world has been decreasing worldwide, such decreases have been historically offset and surpassed by growth in developing countries.7 While such growth has moderated in recent years, the overall volume of cigarette consumption has plateaued and demonstrates, at best, an overall slowly declining trend.

Low or slowly declining revenue growth can actually act as a benefit to the sustainability of dividends. Growing companies must often fuel expansion with significant capital expenditures and working capital needs which can create liquidity issues. Low or slowly declining revenue growth conceptually requires very little cash outlays for such expenditures, and in the case of working capital, liquidating current assets (e.g., reduced receivables, inventory, etc.) can actually contribute to operating cash flow.

Tobacco is more than a cash crop; it is a cash cow. To wit, the three largest publicly traded tobacco companies in the world produce an average dividend yield of almost 7.0% – with some companies yielding far higher. This is well above the S&P500’s dividend yield of 1.6%.8

Operating cash flow, along with an analysis of solvency and debt service, is a key metric in determining the sustainability of cash flows. Tobacco companies’ capabilities to sustain such dividends appear strong.

In addition, today’s world requires sustainable business models from the perspective of future lockdowns. Unlike many industries, the production and distribution (e.g., convenience stores, gas stations, supermarkets, etc.) of tobacco products were largely unaffected by either Covid-19 or related containment efforts.

Finally, decreased revenues from cigarette smoking may be negated by increased revenue from non-smoking tobacco products (e.g., electronic cigarettes and vaporizers) and cannabis. Many major tobacco companies have already invested in such businesses: Altria bought both e-cigarette company Juul and a 45% stake in the cannabis company Cronos Group in 2018, while Imperial Brands bought Auxly Cannabis that same year.

These trends should continue, as cannabis production and distribution fit naturally well with current tobacco company business models. Such companies are well positioned as the cannabis industry’s future low-cost producers given their scalability potential from extensive farming networks, manufacturing prowess, marketing expertise, and established distribution system. Given the House of Representatives’ recent vote to remove marijuana from the federal Controlled Substances Act, this future may be fast approaching.9

When ESG-compliant stock screeners automatically filter out tobacco stocks, an opportunity for investors exists with unfiltered tobacco.

About WindRock

WindRock Wealth Management is an independent investment management firm founded on the belief that investment success in today’s increasingly uncertain world requires a focus on the macroeconomic “big picture” combined with an entrepreneurial mindset to seize on unique investment opportunities. We serve as the trusted voice to a select group of high-net-worth individuals, family offices, foundations and retirement plans.

312-650-9822

Endnotes:

- Shiller PE Ratio. https://www.multpl.com/shiller-pe

- Kell, George. “The Remarkable Rise of ESG” Forbes. 11 July 2018. https://www.forbes.com/sites/georgkell/2018/07/11/the- remarkable-rise-of-esg/?sh=452198fd1695

- Collins, Sean. Sullivan, Kristen. “Advancing Environmental, Social, and Governance Investing” Deloitte Insights. 20 February 2020. https://www2.deloitte.com/us/en/insights/industry/financial-services/esg-investing performance.html#:~:text=The%20sustainability%20movement%20is%20growing,- Social%20consciousness%20has&text=Globally%2C%20the%20percentage%20of%20both,to%2075%20percent%20in%202019

- United Nations. Sustainable Development Goals. https://www.un.org/sustainabledevelopment/health/

- Gallup. “Tobacco and Smoking” https://news.gallup.com/poll/1717/tobacco-smoking.aspx

- Our World in Data. “Smoking” https://ourworldindata.org/smoking and Centers for Disease Control and Prevention. “Current Cigarette Smoking Among Adults in the United States” https://www.cdc.gov/tobacco/data_statistics/fact_sheets/adult_data/cig_smoking/index.htm#:~:text=In%202019%2C%20nearly%2014%2 0of,with%20a%20smoking%2Drelated%20disease

- Statista. “Global Cigarette Consumption from 1880 to 2017” https://www.statista.com/statistics/279577/global-consumption-of- cigarettes-since- 1880/#:~:text=World%20consumption%20of%20cigarettes%201880%2D2017&text=This%20statistic%20shows%20the%20historical,tri llion%20cigarettes%20were%20consumed%20worldwide

- Charles Schwab & Co., Inc. as of December 17, 2020 with market capitalizations provided by CompaniesMarketCap.com.

- ABC News. “House Passes Historic Bill to Decriminalize Cannabis” 4 December 2020.

All content and matters discussed are for information purposes only. Opinions expressed are solely those of WindRock Wealth Management LLC and our staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas presented do not constitute investment advice and investors should discuss any ideas with their registered investment advisor. Fee-based investment advisory services are offered by WindRock Wealth Management LLC, an SEC-Registered Investment Advisor. The presence of the information contained herein shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services. WindRock Wealth Management may have a material interest in some or all of the investment topics discussed. Nothing should be interpreted to state or imply that past results are an indication of future performance. There are no warranties, expresses or implied, as to accuracy, completeness or results obtained from any information contained herein. You may not modify this content for any other purposes without express written consent.